Sustainable-Return On Investment (S-ROI)

Identify Stakeholder Risks and Opportunities in a Financially Oriented Framework

What is S-ROI? A Powerful Decision-Making Tool for Corporate and Government Projects

Moving Beyond Net Present Value (NPV) to Spot Stakeholder Risks and Opportunities in a Financially Oriented Framework

Sustainability-oriented analytical techniques, like Life Cycle Assessment (LCA), provide insights into the environmental impacts of products and factories. They are increasingly guiding product and process design (e.g., the development of cold-water laundry detergents and vehicle light-weighting) and have generated significant environmental and financial returns.

But many business decisions have, in addition to environmental consequences, effects on local individuals, communities, and economies. These potential societal impacts are frequently ignored during planning for plants, facilities, civil infrastructure, and other projects, which typically focuses on traditional Return on Investment (ROI) analysis.

So, when impacts emerge, they create unforeseen expense, hardship and disruption for stakeholders and businesses alike. If a fishing ground has to be closed because of a toxic mishap, it can devastate hundreds of families and businesses, and create potentially huge liabilities.

What if social and economic risk factors could be uncovered, along with environmental factors, early on in the planning process? What if potential stakeholder impacts could be highlighted in a way that helped generate new options that benefitted all parties? And what if these benefits could be quantified and incorporated into a broadly accepted financial decision-making framework? Planners could then proactively avoid risks and maximize previously invisible opportunities – reducing the potential for surprises and improving their project’s chances for strategic success.

That’s the promise of Sustainable Return on Investment (S-ROI), a rigorous financially oriented framework that combines well-established analytical techniques with a proven approach to collaboration and dialog. As developed by a growing group of businesspeople, academics, and researchers, and utilized by a range of companies and government organizations, S-ROI identifies and weighs critical potential impacts of a proposal, and engages stakeholders in a process of non-adversarial analysis and optimization.

Success Stories to Date Include:

- Dow Chemical’s use of S-ROI for three planning cycles to measure the return to the company on their 10-year sustainability goals. They estimate that the current goals will return $1 billion in cost savings or new cash flow for the company and will benefit the lives of 1 billion people.

- An analysis conducted for the Japanese government showed positive ROI for its support of biogas production as a method of handling plant and animal-based waste products.

- A mining company in South Africa discovered that a relatively modest investment in HIV/AIDS education produced clear net positive ROI for itself and its surrounding communities.

EarthShift Global founder and CEO Lise Laurin is a frequent speaker and presenter on the subject, and the leader of the team that developed 3 Pillars, the only general-purpose sustainable (S-ROI) software package on the market.

Lise Laurin’s sustainability research has focused on how traditional accounting methods (direct and indirect costs) can be combined with quantified analysis of risks and benefits to stakeholders to calculate a net present value (NPV) of the decision for each stakeholder through the project’s time horizon. Her hands-on S-ROI project leadership experience includes work that has won praise from organizations like the National Agriculture Research Organization and the US State Department, World Environmental Center, and Pratt & Whitney.

S-ROI goes beyond traditional NPV methods to incorporate uncertain costs and benefits that would otherwise be overlooked. This isn’t an attempt to predict the future, but a way of preparing for it, by considering:

- Contingent liabilities: liabilities that depend on the outcome of future uncertain events (e.g. clean-up costs and penalties after a chemical spill or unanticipated runoff)

- Intangibles: impacts and liabilities that don’t typically show up on the balance sheet but can materially impact long-term financial returns (e.g. brand reputation, community relations)

- Fluctuating prices

- Possible new regulations

- Shifting consumer preferences

By also including dialogs with stakeholders, S-ROI goes a step further, encouraging not only transparency but the development of optimized approaches that simultaneously reduce impacts, avoid risks, and increase chances for overall success.

Working with the Sustainable Return on Investment (S-ROI) methodology, EarthShift Global can help you uncover potential costs hidden by traditional accounting procedures.

How Does S-ROI Work?

In simplest terms, S-ROI is a process of:

- Systematically identifying possible future events that might affect an investment’s payback,

- Considering the likelihood that they will occur, and,

- Assessing the consequences.

Estimating the impact of future events always entails uncertainty. But complex projects aren’t like rolling dice or flipping coins – we can’t assign hard probabilities to each outcome. Instead we can leverage Bayesian techniques and use the knowledge of stakeholders inside and outside an organization to model uncertainty and provide guidance for decision-making.

In many instances, simply taking the first cut at this exercise can identify important decision factors. For example, in the case of a manufacturing plant, could employee misprocessing cause an industrial accident? Asking this question prompts a discussion around training that likely wouldn’t have occurred in a conventional NPV analysis. S-ROI can then go further to quickly show whether preventive costs, such as making training an integral part of the overall project or adding redundant safety systems, create an unnecessary burden or provide an unexpected payback.

After identifying scenarios with different probabilities of occurrence, the next step is to evaluate costs and benefits for each stakeholder. S-ROI then samples all possible scenarios and respective costs to yield a best case, worst case, and most probable return on investment. With this range of results, we can identify the real risks to profitability (or sustainability) and make a decision that best balances each consideration.

An important part of the process is a dialog with stakeholders. Ideally, this involves representatives of groups that could be affected by the proposed project. For example, in the case of a project that could affect fishing grounds, relevant stakeholders might include nearby residents, farmers, real estate professionals, fishermen, chambers of commerce, or law enforcement. When direct representation is not feasible, proxies can be used.

In our two decades of work in long-term LCA, we have found the dialog approach to be superior to simple mathematical metrics. It allows us to tap into a greater knowledge base and create mutual understanding. This often leads to innovative, mutually beneficial solutions that would not have otherwise come to the surface. For example, the mining company Rio Tinto in South Africa discovered through S-ROI analysis that providing HIV/AIDS education could not only improve the health of individual workers, but also the overall well-being of communities around its sites – all of which provided strong long-term ROI on the up-front investment.

What Does a Typical S-ROI Process Look Like?

Conducting an S-ROI analysis is generally about a month-long endeavor that requires both strong process management and suitable software. With these in place, the payback on effort and investment can be tremendous, especially for strategic decision-makers who need long-term visibility.

The S-ROI Process Offers a Picture of the Future, including Best-case, Most-probable, and Worst-case Scenarios

Results are delivered in NPV terms, which are readily understood and accepted by financial experts in your organization. We then help you make sense of the S-ROI output and create a simple, accessible presentation for decision-makers within your firm.

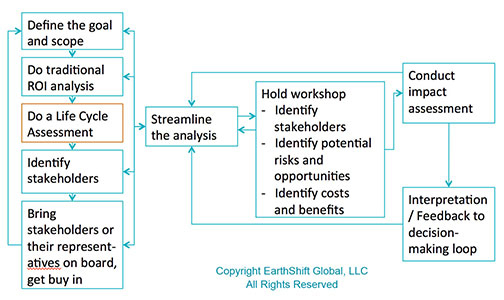

Here is a general outline of the steps involved: (refer to above diagram)

- Define the project goal, scope, and alternatives, and conduct traditional ROI analysis as a baseline. Optionally, for projects involving environmental impacts, conduct a screening LCA and environmental and hazard risk assessments as appropriate.

- Identify stakeholders or proxies, including those outside the project’s immediate geographic area and supply chain, and conduct a workshop. Face-to-face interaction encourages the contribution of ideas and exploration of alternatives and ensures that the most and best information get incorporated into the analytical process. This allows prioritization of stakeholders (including the company or government agency) and identification of opportunities and risks for each one.

- Create scenarios and assign a range of probabilities to each. Part of this process is eliminating those without substantial impact, and assigning costs and benefits (including non-traditional costs).

- Conduct financial analysis for each stakeholder of interest with best case, worst case, and most probable case. This can be a simple spreadsheet analysis, or a more advanced simulation, e.g., Monte Carlo (PDF), which provides a more robust analysis of possible outcomes.

- Review impact assessment with stakeholders to ensure completeness and consensus, and implement findings in the decision/planning process

The Next Time You Face a Tough Decision or Need to Evaluate the Feasibility of a Project...

Let us apply S-ROI techniques to help you understand the costs and benefits ahead of time so you can get the most out of your project planning efforts and chart your course with a triple bottom line in mind.

Fluctuation in fuel prices, potential new regulations, changes in consumer preferences, are other examples of decisions affected by uncertainty and where S-ROI analysis can help ensure maximum benefits including whether to invest in pollution prevention devices, make an acquisition, or whether or not to expand a facility.

EarthShift Global’s extensive sustainability knowledge and experience provide a novel, forward-looking approach as well as specific insights – even during the proposal process.

Interested in learning more about our S-ROI solutions?

Please call +1 (207) 608-6228, contact us by email for a personal consultation, or use our consulting services inquiry form.